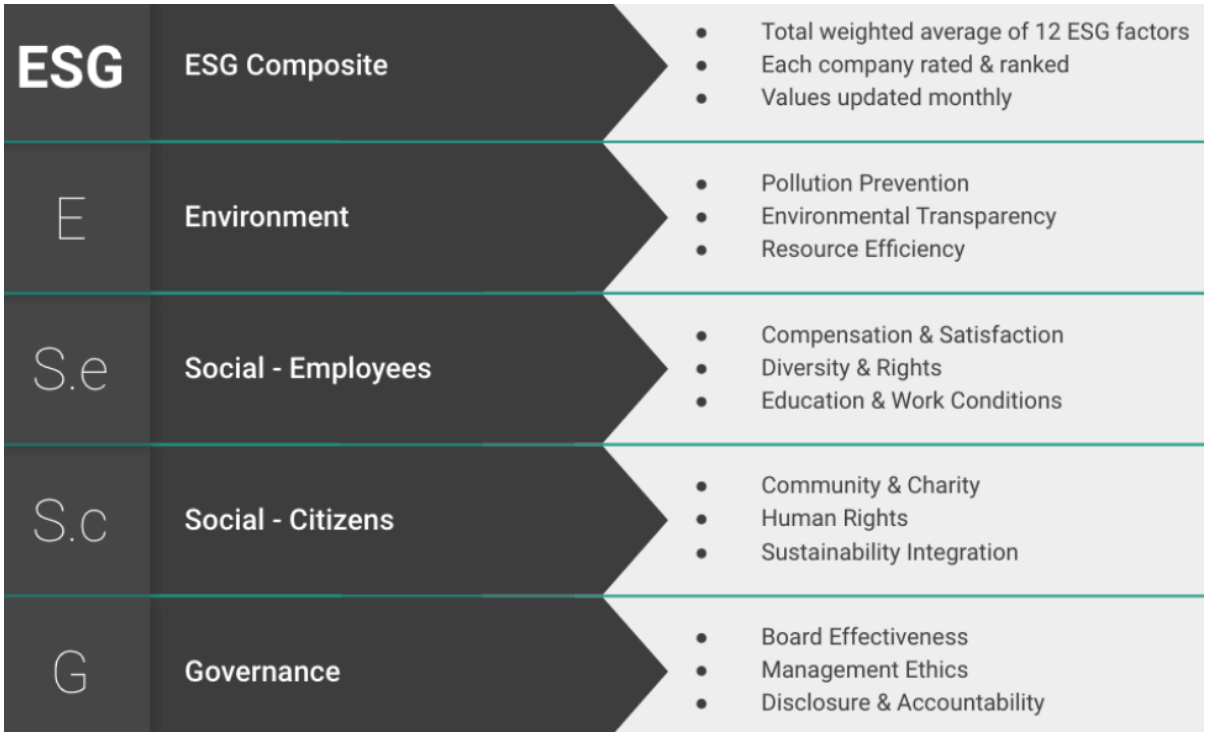

Last week, we reiterated our view that the investment community is uniquely positioned to effect positive change by deploying capital in companies that score well on Environmental, Social, and Governance factors. To that end, we walked through the framework of a high quality ESG dataset, courtesy of our partners at OWL Analytics (shown again below).

Today, we’ll highlight how the Human Rights factor has historically performed (2015-2019), due to it having the most pronounced alpha out of all of the Social indicators over the past five years.

Methodology

Using the Russell 1000 as our universe, we created a market and GICS 1 sector neutral Human Rights portfolio, where the long book is comprised of names that, leveraging OWL’s criteria for Human Rights, score well (have positive exposure), and the short book contains companies that score the worst (have negative exposure).

The portfolio was monthly rebalanced to ensure that it was picking up the latest OWL data and equally weighted to ensure we weren’t overly emphasizing any particular stock or a group of stocks (e.g. FANG).

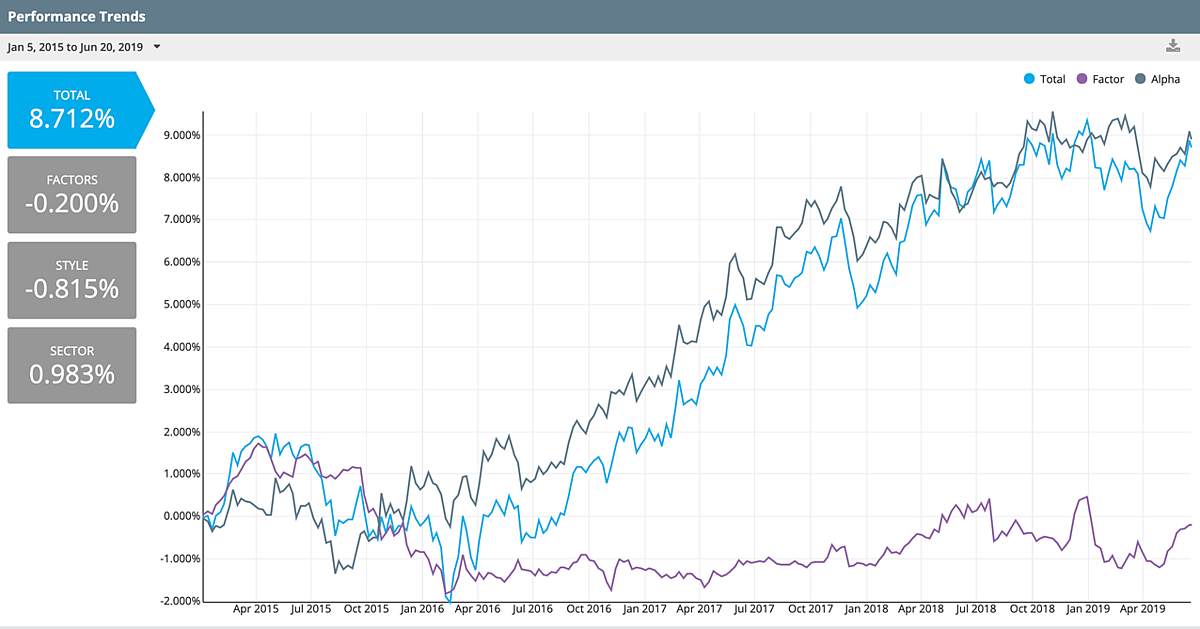

Human Rights: Cumulative Performance (1/1/15 – 6/20/19)

As you can see, this portfolio saw some ups and downs throughout 2015, then started generating consistent positive returns since Fall 2016. Throughout this period, the positive gains can be solely attributed to alpha (stock specific contribution), while there was a slight bit of factor drag (to the tune of -20bps).

Where Does This Alpha Come From?

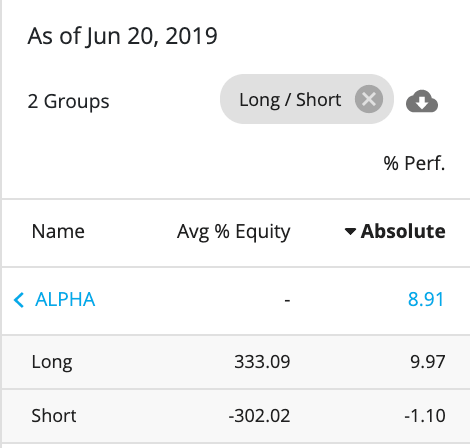

If we take a look at the long/short split in alpha contribution to return for this Human Rights portfolio, we see that

all of the alpha is coming from the longs. This suggests that it’s better to tilt towards companies that exhibit positive Human Rights behaviors than shorting names that have poor Human Rights practices.

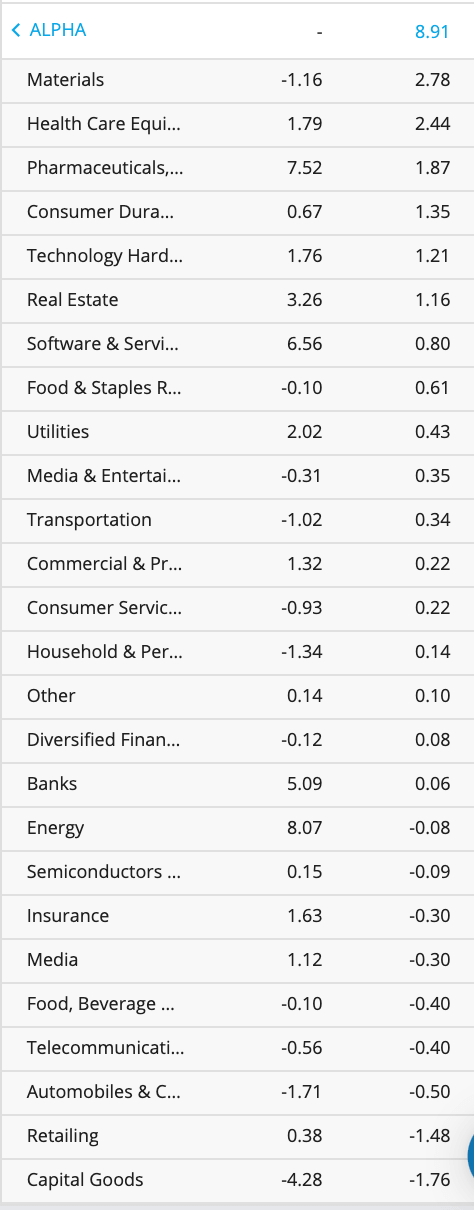

Here’s the breakdown when we look at total performance of this portfolio from an industry perspective:

Human Rights: Total Performance Contribution at the Industry Group (GICS 2) level (1/1/15 – 6/20/19):

Since the portfolio is constructed to be GICS1 sector neutral, we observe whether some sub-industry tilts contributed to the alpha of this portfolio:

Interestingly, the biggest industry group alpha contributor in the Human Rights portfolio was the fact that it was underweight Materials. Not surprisingly, being overweight Health Care Equipment, Pharma, and Tech (Hardware & Software) contributed to the positive alpha. We see that a material underweight to Capital Goods and a small underweight to Retailing generated an alpha drag.

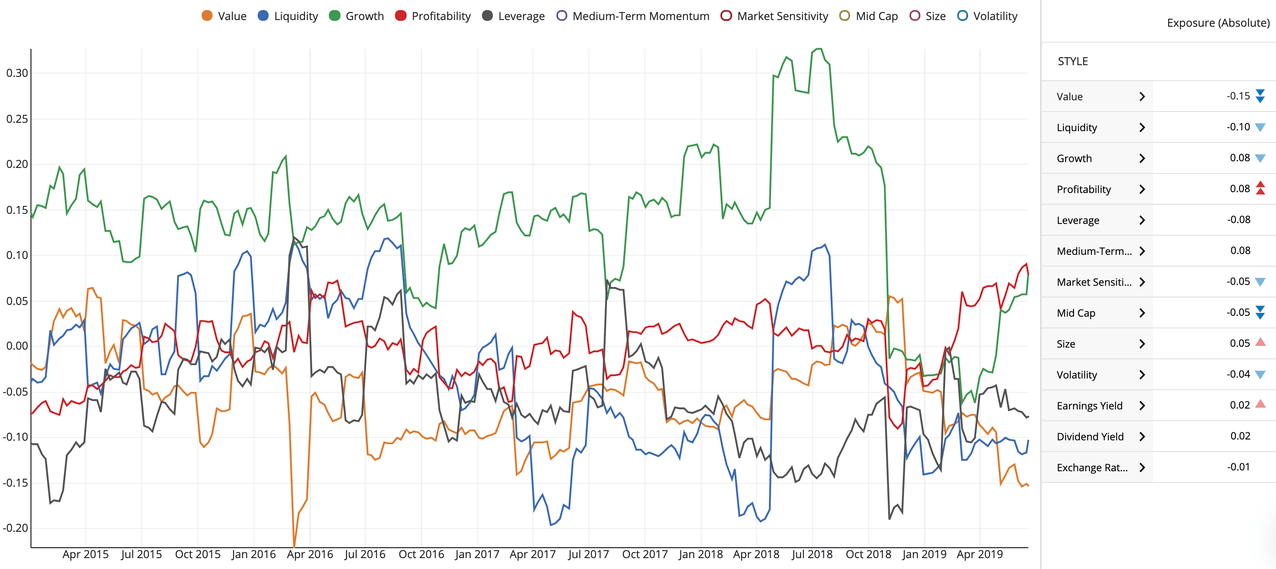

Human Rights: Style Factor Exposures

Now, let’s take a look at the Human Rights portfolio’s exposure to Style factors found in a traditional risk model. This will allow us to better understand what other exposure an investor is taking on when tilting towards companies that score well on Human Rights.

Human Rights: Top 5 Style Exposures (1/1/15 – 6/20/19)

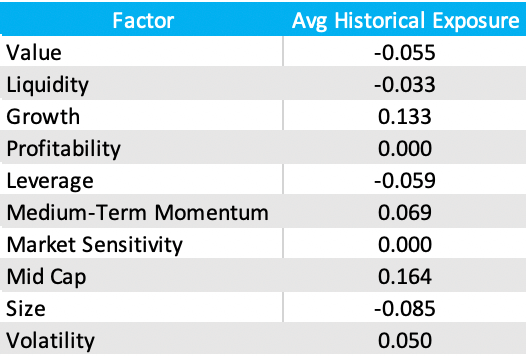

Here we see that at the end of this date range, the Human Rights portfolio’s largest style biases were being underweight Value and Liquidity, and long Growth and Profitability. This is what the portfolio’s average exposures looked like for this 4.5 year period:

Human Rights Portfolio: Average Style Exposure (1/1/15 – 6/20/19)

Overall, these exposures appear to be quite balanced. We can see that the Human Rights portfolio has typically been slightly underweight exposure to Value and overweight Growth. It also tends to favor more midcap stocks in the Russell 1000 than the mega or large-caps.

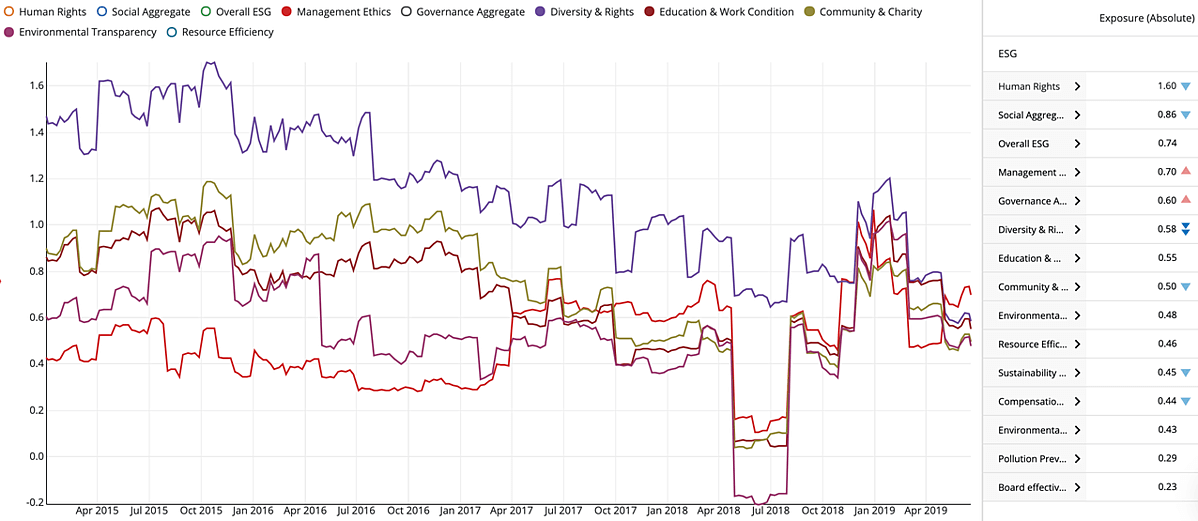

Human Rights: Top 5 ESG Factor Exposures (1/1/15 – 6/20/19)

The last piece to consider here is, what other ESG factor exposures this portfolio carries, which is helpful insight for any investor looking to increase his or her exposure to companies that score well on Human Rights.

To pinpoint the ESG read-throughs of this portfolio, we’ll ignore exposure to Human Rights (which is obviously high) and the aggregate factors (Overall ESG, Social Aggregate, and Governance Aggregate). Most recently, this portfolio had the highest exposure to Management Ethics, Diversity & Rights, Education & Work Condition, Community & Charity, and Environmental Transparency.

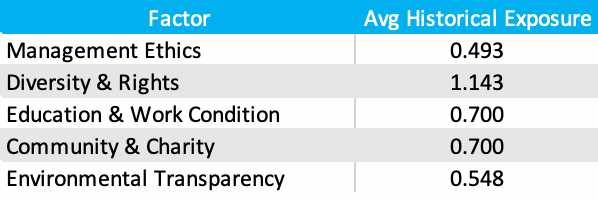

Here is how the top 5 ESG factor exposures averaged over that 4.5 year period for this portfolio:

An investment in Human Rights yielded positive exposure to each of these similarly important ESG factors, most notably carrying a significant exposure (>1) to Diversity & Rights. Both that factor and Human Rights have performed well over time, which is a trend we expect and hope to see continue in the future.